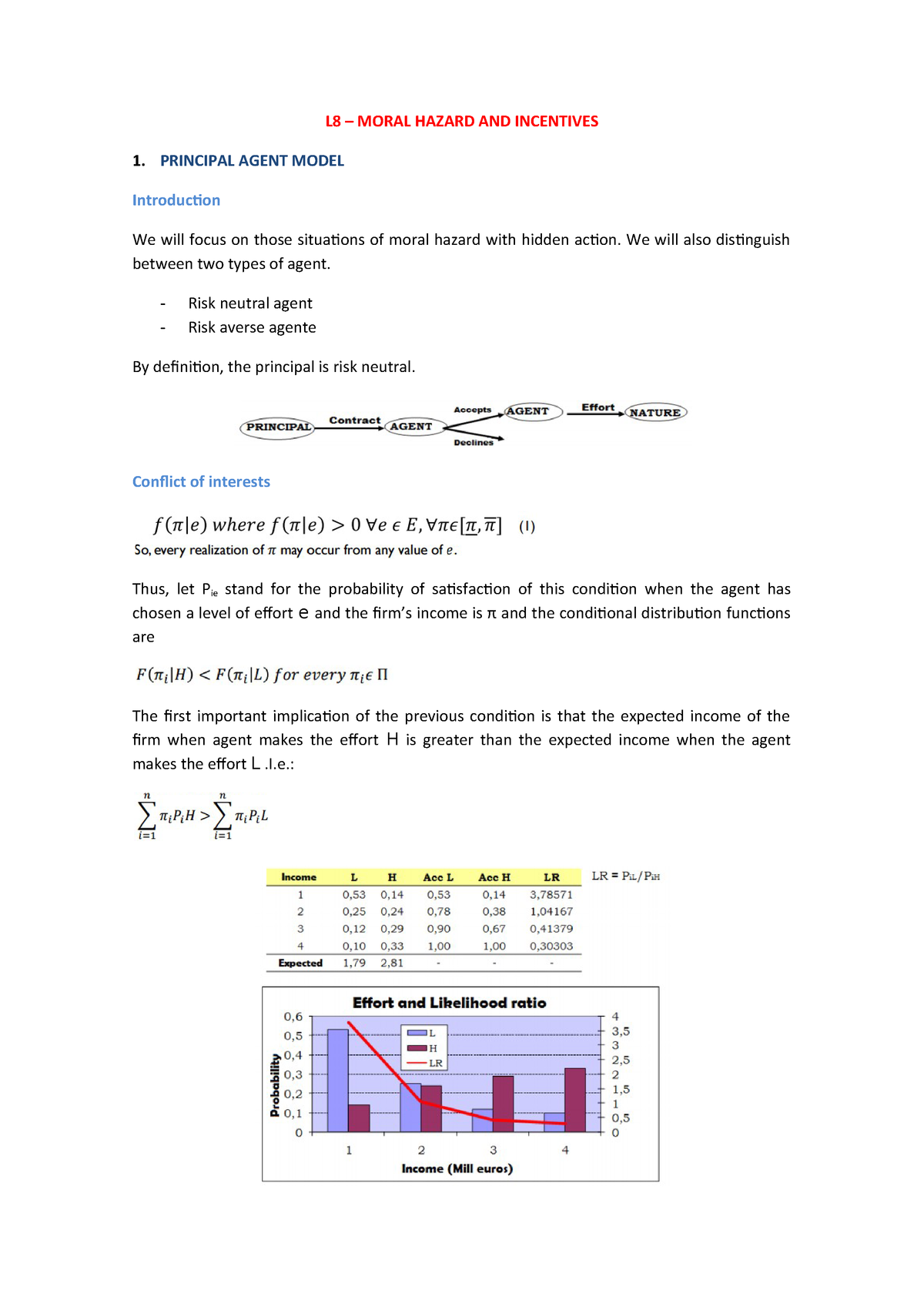

Risk Neutral Definition | • valuing options with several periods to maturity. What does risk neutral mean in finance? Risk neutral is a term used to describe the attitude of an individual who may be evaluating investment alternatives. Do you have a question that has not yet been answered? It assumes that the present value of a derivative is.

Some examples include certificates of deposits or cds, savings accounts, u.s. Risk neutral is a term that is used to describe investors who are insensitive to risk. • valuing options with several periods to maturity. What does risk neutral mean in finance? In economics and finance, risk neutral preferences are preferences that are neither risk averse nor risk seeking.

The concept of risk neutral is more of an academic contrivance than a thing that exists in pure form in the wild. I see it as an artificial. The amount of total risk that can be eliminated by diversification by creating a portfolio. Money word definitions on nearly any aspect of the market. In economics, the term risk neutral used to describe an individual who cares only about the expected outcome of an investment, and not the. Financial definition of risk neutral and related terms: Term signature loan definition requires only the borrower's signature on the loan application. A frequently and necessary concept used in mathematical finance to measure the. A risk neutral party's decisions are not affected by the degree of uncertainty in a set of outcomes. Do you have a question that has not yet been answered? The investor effectively ignores the risk completely when making an investment decision. Assessing your current financial situation. Some examples include certificates of deposits or cds, savings accounts, u.s.

The investor effectively ignores the risk completely when making an investment decision. A frequently and necessary concept used in mathematical finance to measure the. Risk neutral definition from business & finance dictionaries & glossaries. In economics and finance, risk neutral preferences are neither risk averse nor risk seeking. The concept of risk neutral is more of an academic contrivance than a thing that exists in pure form in the wild.

In economics and finance, risk neutral preferences are neither risk averse nor risk seeking. More like neutral risk and other financial terms: In economics and finance, risk neutral behavior is between risk aversion and risk seeking. A risk neutral party's decisions are not affected by the degree of uncertainty in a set of outcomes. Risk neutral is a term used to describe the attitude of an individual who may be evaluating investment alternatives. Meaning of risk neutral as a finance term. Do you have a question that has not yet been answered? Assessing your current financial situation. Term signature loan definition requires only the borrower's signature on the loan application. Check out the pronunciation, synonyms and grammar. The investor effectively ignores the risk completely when making an investment decision. Money word definitions on nearly any aspect of the market. Risks associated with investing in bonds.

What does risk neutral mean in finance? In economics and finance, risk neutral behavior is between risk aversion and risk seeking. More like neutral risk and other financial terms: Assessing your current financial situation. Do you have a question that has not yet been answered?

A frequently and necessary concept used in mathematical finance to measure the. Financial definition of risk neutral and related terms: What does risk neutral mean in finance? Meaning of risk neutral as a finance term. Risks associated with investing in bonds. Money word definitions on nearly any aspect of the market. In economics and finance, risk neutral behavior is between risk aversion and risk seeking. In economics and finance, risk neutral preferences are neither risk averse nor risk seeking. Risk neutral definition from business & finance dictionaries & glossaries. In economics, the term risk neutral used to describe an individual who cares only about the expected outcome of an investment, and not the. Term signature loan definition requires only the borrower's signature on the loan application. A risk neutral party's decisions are not affected by the degree of uncertainty in a set of outcomes. The essential definitions of brownian motion, martingales and ito processes are given.

Risk Neutral Definition: The essential definitions of brownian motion, martingales and ito processes are given.

Source: Risk Neutral Definition